Dry goods: how to realize online logistics cost management through digitalization?

Source of the following article: Tina from the stars

Author: Tina from the stars

About the author: graduated from Hong Kong Polytechnic University. Deeply cultivate the supply chain and solutions. One professional article on supply chain and one literary and psychological essay every week.

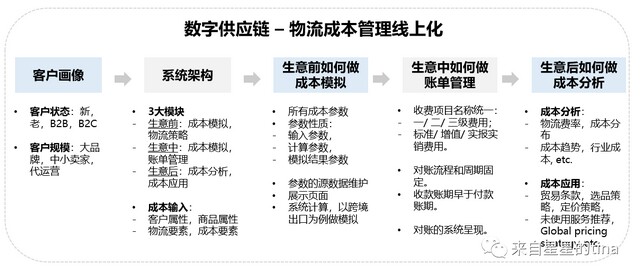

From the perspective of platform e-commerce and sellers, this paper explains in depth how to make logistics costs online from five aspects. The article is relatively long. Put a directory for everyone to read. The supply chain and logistics costs in this paper do not include procurement, marketing and other costs. We still talk about how to digitize the logistics cost around the three words of the supply chain (purchase, sales and inventory). The logical structure and framework of cost digitalization in this article is applicable not only to platform e-commerce, but also to self operated e-commerce, e-commerce sellers themselves, as well as traditional enterprises.

01

Customer (seller) portrait

Before doing cost analysis and online, we must first define the customer portrait. Why? Because different types of customers pay different attention to cost.

The main business of platform e-commerce customers is B2C, sometimes B2B2C, and some customers will use platform B2B and B2C services at the same time. Customer portraits can be broken down by customer status and customer size.

1. Customer status

New customers: those who have not yet done e-commerce business but intend to do so, pay more attention to the overall logistics cost and the logistics rate per unit commodity, that is, the proportion of logistics cost to the selling price.

Regular customers: those who have operated e-commerce for a period of time pay more attention to the logistics costs incurred and the accuracy and clarity of bills.

B2B customers: the logistics costs of B2B are mainly international transportation and related costs, which are separated separately because such customers care about the logistics costs of each order before transportation. The differences in transportation modes (air, sea, land, railway, air sea combined transportation) and trade terms (FOB, CIF, EXW, FCA, CFR, etc.) will greatly affect the costs.

2. Customer size

Big brands: especially global pricing brands, they pay more attention to the impact of logistics costs on the overall p&l (profit & loss), and logistics costs will also directly affect their global pricing strategies.

Small and medium-sized customers: whether this order or these commodities can make money and whether they can make profits in the short and medium term is their more concern.

Agent operation: many brands or companies, especially cross-border e-commerce, will have agent operation locally. Agent operation should report to the brand regularly, so they pay more attention to the logistics cost of the industry.

02

System architecture of cost management model

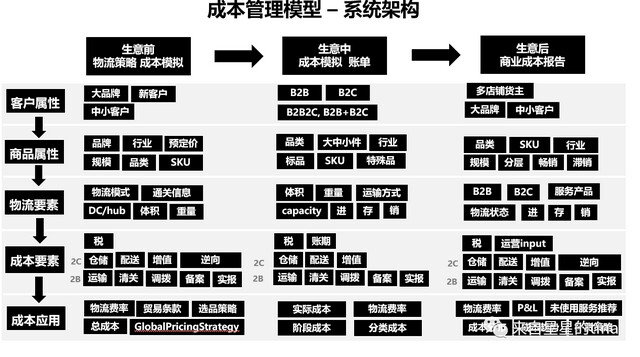

1. The cost management system is divided into three modules

Pre business: Cost Simulation and logistics strategy. Cost simulation mainly looks at the proportion of logistics costs of various categories and SKUs according to commodity attributes, logistics elements and cost elements. Logistics strategy refers to the logistics mode or link to be selected, whether the B2C part is direct mail or stocking to dc/cdc/rdc; What kind of transportation mode and trade terms should be adopted in B2B?

In business: Cost Simulation and bill management. Post cost simulation is still used in business. For example, every order of international transportation needs to look at the logistics cost in advance, or there are new products on the shelves. The bill is after the business has occurred, a clear accounting period, clear and standardized bills are very important.

Post business: generate business cost analysis and reports. For example, visual reports on cost changes and trends, total costs, unit costs, and P & L. at the same time, ask questions and analyze whether the cost is healthy. If the cost is too high, how to reduce the cost? For example, by reducing the shortage rate of explosive funds through supply chain planning and operation, can we change from air transportation to sea transportation? For the platform, we can also recommend some competitive services to customers.

2. Input of cost management system

Only when the existing cost related parameters are input can the cost analysis be output. Most of these inputs are the basic information (customer information, commodity information, logistics information) precipitated by the system, which can be called between various systems. There are also some information that needs to be entered or selected by customers, such as whether they want air transportation or sea transportation, volume and weight of new commodity SKU dimension, commodity pricing, etc.

Customer attributes. Customer scale (large, medium and small), new and old customers, brand customers, multi store shippers, B2B, B2C, etc.

Product attributes. Industry, category, scale, SKU, predetermined price; Standard product or special product; ABC stratification of goods, best-selling or slow-moving, etc.

Logistics elements. Logistics mode (direct mail, CDC, RDC), goods customs clearance information, volume, weight; Mode of transportation, purchase, sale and storage; Trade mode, origin, destination, etc.

Cost element. Tax (in fact, it does not belong to the cost of supply chain and logistics, but the tax of platform e-commerce is collected and paid on behalf of others, which will also be seen in the supply chain and logistics departments), storage fees, distribution fees, operation fees, transportation fees, reverse, transfer, etc.

03

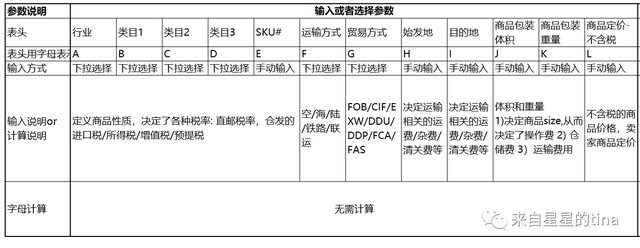

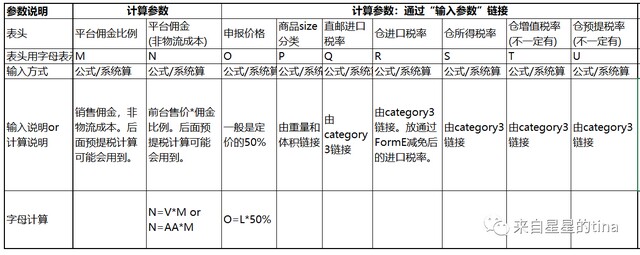

Before business: how to do cost simulation

Cost simulation is not a simple thing. If it is not done accurately, it is better not to do it. At the same time, the premise of online cost simulation must be that there must be a set of accurate calculation templates offline, which will be moved online after the application is mature.

Flexport, which has done a good job in online cost simulation, launched the pre service cost estimation for international transportation a few years ago.

Source: flexport official website

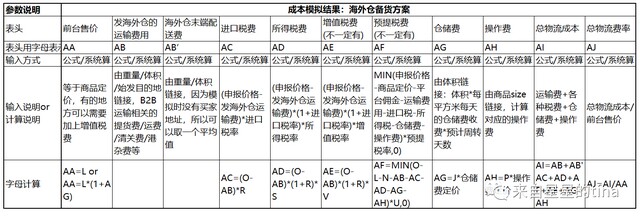

Then take the cross-border export e-commerce as an example (because it is the most complex. If the cross-border export cost simulation will be done, the rest will be simple). How to do the cost simulation? List all parameters that affect cost: that is, the parameters in the "input of cost management system" mentioned above: commodity attributes, logistics elements, and each parameter in cost elements. Confirm parameter nature: enter or select parameters that need to be entered manually or can be selected from the drop-down list: category, transportation mode, trade mode, origin, destination, commodity volume, commodity weight, and background pricing excluding tax. Calculation parameters, through "input parameters" as the link carrier, after maintaining the source data, can be calculated by formula or automatically by the system: declared price, commodity size classification, various tax rates. Cost simulation result parameters, total logistics cost and logistics rate under different logistics links. Make the cost simulation page display page. Collect the corresponding information or price / cost in "calculation parameters" and maintain it regularly as source data. At the same time, it is connected with the cost simulation display page for calculation. What are the main source data that need to be maintained: international transportation related: freight / port charges / customs clearance fees / pick-up fees, etc. the fees will vary with the origin, destination, transportation mode and trade mode. Terminal delivery fee: express delivery fee corresponding to different weight / volume and different routes. The storage fees of various tax rates (direct mail import tax rate, overseas warehouse import tax rate, income tax, value-added tax, withholding tax) corresponding to the category are generally charged by the market in the form of xx/ cubic meter / day. The operation fee is generally charged by the market according to the size of the product, that is, oversized / large / medium / small pieces. Reverse logistics related, reverse logistics related costs, average return proportion by category. When there are goods to be cost simulated, the information in manual input or "input parameters" will be calculated automatically. The specific simulation process and template can be referred to the following figure (positive cost, excluding reverse logistics costs caused by returns, etc.). Digitalization is to present these data and information in the system.

04

In business: how to manage bills

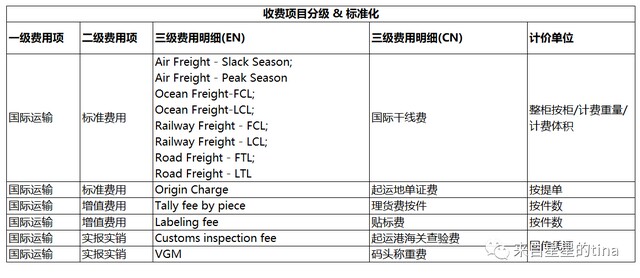

After entering the routine business flow, regular and clear bills are very important. It often happens that customers are lost because the bill is not clear. Especially when there are many customers, and the same customer also carries out multiple business cooperation, and there are B2B and B2C businesses at the same time, it is easy to have unclear bills and chaotic accounting periods. A good bill needs to start from three aspects: charge items, reconciliation process and accounting period. What digitalization needs to do is to have a clear presentation on the system. 1. The name of charging items should be unified upstream and downstream, and the name of charging items should be clear and concise. At the same time, the name of suppliers and clients should be unified, so that reconciliation is easy. When multiple businesses are carried out at the same time, many charges are very complex. The same charge item often appears, and the names often appear on the bill are different. The supplier's bill and the bill to the customer are also diverse, so it is impossible to reconcile at all. The charging items can be divided into three levels: first level fee items: service items. For example, international transportation is a first-class project. Level 2 expenses: they can be divided into three categories: standard expenses (as long as the service is used, there must be); Value added expenses (in addition to the fixed expenses, the expenses arising from the value-added services actively requested by customers); Reimbursed expenses (not within the scope of quotation, the expenses charged by the third party may not occur, but there must be vouchers) level 3 expense items: more detailed than level 2. For example, sea freight, air freight and customs clearance fees in standard fees; Among the value-added expenses, the fees for marking, dismantling, labeling, and labeling; The inspection fee and dock weighing fee in the actual expenses.

Take international transportation as an example:

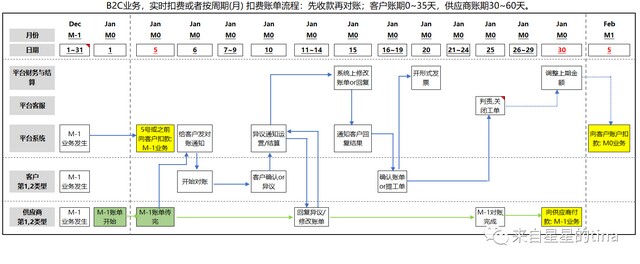

After these categories are clear, online is also relatively simple. Configure these charging items. When suppliers upload bills and sellers confirm / raise objections, just check them accordingly. 2. The reconciliation process and reconciliation cycle should be fixed. There are three deduction modes for platform e-commerce to customers: the first is to deduct fees when orders are generated. Including order operation fee and terminal delivery fee. These orders happen every day, and there may be tens of thousands of orders every day. But this part is easier to deal with. The second one is to deduct fees according to the time period. For example, the storage fee is settled monthly. Third, the fee is deducted after a period of time after the order is generated. Including transportation related expenses, the reconciliation time may be longer, because B2B orders are relatively scattered, there may be several orders a month, and there may be dozens of hundreds of orders. At the same time, many reimbursement fee vouchers need dozens of days to come out. The first and second are mainly B2C orders, and the third is mainly B2B orders. If each deduction mode uses a different reconciliation cycle and process, the reconciliation process will become very complex, so the reconciliation process and time under the three deduction modes should be as close as possible. Corresponding reconciliation suggestions: the first is to deduct money first, and each business is deducted in real time. If there is an error between the reconciliation of each period and the actual deduction, the next period will be adjusted.

The bill of M-1 (last month) shall be issued before the 5th of M0 (current month).

On the 6th to 10th, the customer raised an objection to the bill and the actual deduction.

From November 11 to 15, the platform will review and confirm and reply to the customer. If there is a problem, modify the bill, and if there is no problem, reply to the customer through the system.

From the 16th to the 20th, the online work order can be initiated for the part that the customer still has objections, and the platform still maintains the account adjustment opening, but no longer infinite reconciliation.

Close the reconciliation on the 20th and issue a proforma invoice to the customer.

21~25, for the bills that the customer still has objections, the customer service will judge and form a conclusion. For those that do have errors, the financial adjustment amount will be made on the 30th, and the adjusted amount will be put into the M1 bill. The excessive deduction will be returned to the customer, and the insufficient deduction will be made up. And enter the next reconciliation cycle.

Second, you can deduct money before reconciliation. If there is any objection, you can adjust the account next month. You can also reconcile money before deduction. If it is more regular, it is recommended to deduct money before reconciliation. The time rhythm is consistent with the first. The third kind can also be settled at a fixed time and on a monthly basis, but it can't be as fast as 1 and 2. It can start on the 5th. Because some reimbursable expenses and vouchers don't come out so quickly, and some need to wait a long time. It is necessary to confirm with the upstream partners the time when a complete charge can be transferred. For example, some charges related to international freight may generally take 15-45 days. Then the supplier uploads all reconciliation details and vouchers before the 15th of M0. The process is the same as that of the first and the second. The difference is that: collection before reconciliation vs. reconciliation before collection. There are four time points:

Time of bill transfer: No. 1-5 of M0 vs. No. 1-15 of M0;

Reconciliation time: No. 6-10 of M0 vs. No. 16-20 of M0;

Time of receiving customer payment: No. 5 of M0 vs. No. 10 of M1;

Payment time to the supplier: No. 30 of M0 vs. No. 10 of M2;

3. There should be a time difference between the collection and payment accounting periods, and no advance money is allowed

The accounting period includes the customer's accounting period and the supplier's accounting period, which refers to the time from the business occurrence to the receipt of the customer's payment; The time from business occurrence to payment to suppliers.

The time of receiving the payment from the customer must be earlier than the time of paying the supplier, otherwise the balance of payments will be unbalanced and the cash flow will be reduced. The accounting period has been reflected in the reconciliation cycle and flow chart in part 2 above.

Under the first and second types of businesses, the payment received from customer M-1 in real time or on the 5th of M0 is 0-35 days vs. the payment from M0 to supplier M-1 on the 30th of M0 after reconciliation is completed is 30-60 days. The collection period is 25-30 days shorter than the payment period.

Under the third type of business, M1 received the payment from customer M-1 on the 10th, and the collection period is 40 days vs. after reconciliation, M2 sent the payment from m2 to supplier M-1 on the 10th, and the payment period is 70 days. The collection period is 30 days shorter than the payment period.

4. How the system presents reconciliation

Clear the name of the charging items and move the corresponding information online. For the reconciliation process and accounting period, the system will block the time point and send notices to customers and suppliers on time. In particular, it is necessary to send a deduction notice in advance so that customers can prepare funds in their accounts in advance, and abnormal processes will also flow in the system.

The presentation of system reconciliation requires:

You can click each order to enter the details page to view the cost list and cost details by order.

Filter item: first and second level expense filter items, business creation time, expense event creation time.

Summary and details: all bills, confirmed bills, unconfirmed bills, bills under objection, bills pending confirmation after objection.

Note: the system bill is presented, and the author simulates it with Excel

05

After business: how to do cost analysis and Application

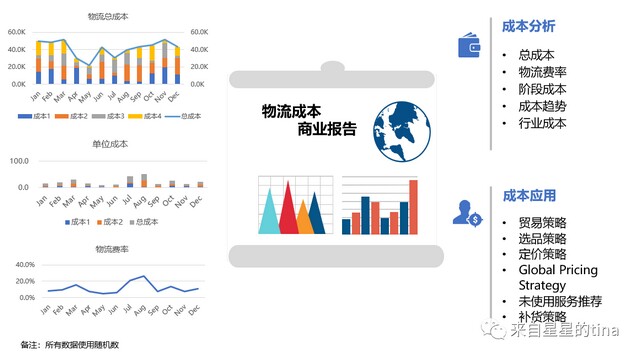

Cost analysis is to summarize and analyze the actual costs, see the trends and changes, and display them with various graphics and icons. Cost application, according to the results of cost analysis, raise questions, optimize the cost structure, reduce logistics costs, or price goods.

Let's talk about several important outputs.

1. Cost analysis

Logistics rate. Logistics cost as a percentage of the selling price. There is no absolute value for this reasonable percentage. For example, for goods of the same volume and weight, high-end cosmetics account for a small proportion, while food with lower prices may have higher logistics costs. It mainly depends on whether it is still profitable or cost-effective after adding logistics costs.

Cost distribution. Which costs account for the bulk? For example, the storage cost of small parts is cheap, but the proportion of operation cost may be high; The storage cost of large items is high.

Cost trends. The change of overall cost and logistics rate, and then analyze the reasons for the change. For example, is the rising trend of national freight costs due to the rising market price or the change of transportation mode?

Industry costs. The average logistics cost by industry, the difference between industries in different costs of purchase, sales and storage, which sellers are lower or higher than the average cost of the industry, and why?

2. Cost application

Trade terms. FOB, EXW, CIF, FCA, etc. will affect the cost. If it is necessary to book shipping space for a long time in advance, and there is much uncertainty, especially when the logistics cost is rising, the FOB terms are beneficial to the seller and detrimental to the buyer.

Selection strategy. For example, small and medium-sized sellers need to pay special attention to the small and medium-sized items with low price, which are greatly affected by logistics costs, thus affecting the stocking mode.

Pricing strategy. For small and medium-sized sellers, logistics costs will directly affect pricing. If the logistics cost rises, the selling price will also increase, which may lead to the lack of competitiveness of goods.

Global pricing strategy. This is used for international big brands, because some brands are priced globally, and the logistics cost will affect tmall's pricing strategy.

Service recommendation is not used. This is for both industry and customers. For the platform, according to the cost analysis, we can recommend some more competitive services to customers; For customers, whether the use of these services can reduce logistics costs.

Replenishment strategy. If the logistics cost of frequent air transportation rises, it is necessary to balance the cost of inventory within the time difference between sea transportation and air transportation. Can we prepare more inventory to reduce transportation costs.

Source / Tina from stars

Author / Tina from stars